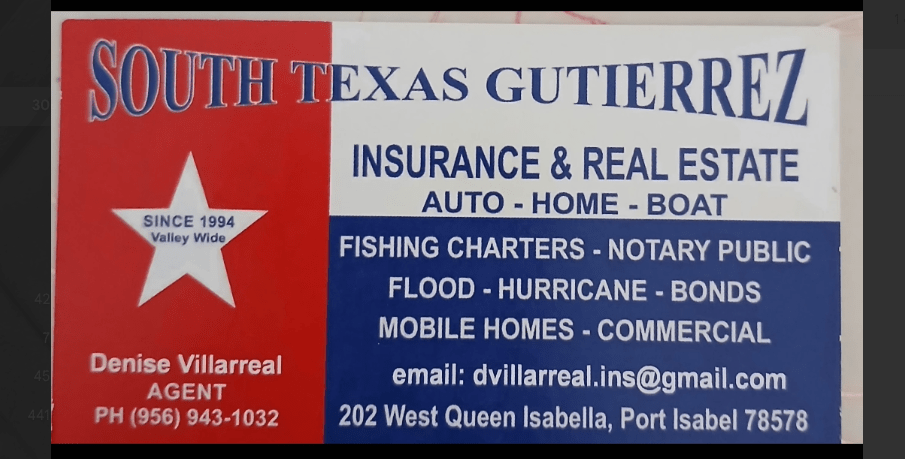

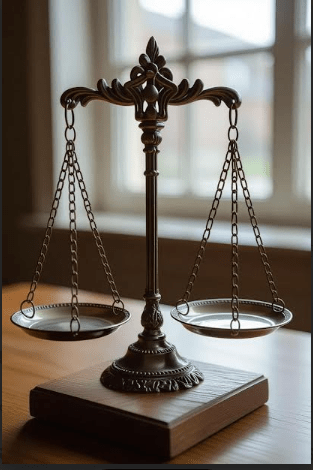

We all know we must pay for car insurance, home insurance and apartment insurance. There is no legal way to get around it.

Ah, insurance—the ultimate “adulting tax” that sneaks into your budget like a ninja in the night. You’re right: for cars, homes, or apartments, skipping it isn’t just unwise; it’s illegal in most places, with fines, license suspensions, or worse waiting in the wings. But here’s the plot twist: what if I told you insurance isn’t just a forced expense—it’s your secret superpower against life’s curveballs?

Let me sell you on why it’s the hero you didn’t know you needed.

- It Shields You from Financial Armageddon Imagine this:

You’re cruising down the highway, minding your own business, when a deer decides it’s auditioning for a demolition derby. Bam—your car is toast, medical bills are piling up, and the other driver’s lawyer is circling like a shark. Without car insurance, you’re on the hook for thousands (or tens of thousands) in repairs, liability, and lost wages. But with it? Your policy swoops in, covers the chaos, and you drive away (in a rental car they often pay for) with your bank account intact.

Same goes for home or renters insurance: A burst pipe floods your place? A storm rips off your roof? Theft guts your stuff? One claim, and poof—replaced or repaired, no dipping into your savings for a “rainy day” that feels more like a hurricane. Bottom line: The average car accident costs $15,000+ out of pocket without coverage. Home claims? Up to $20,000 for water damage alone. Insurance turns “I’m ruined” into “Phew, that was close.”

2. Peace of Mind: The Real ROI Ever lie awake at 3 a.m. worrying about “what ifs”? Insurance is your sleep aid. It’s not just paper—it’s a promise that if disaster strikes (and statistically, it does—1 in 50 homes has a fire claim yearly), you’re not starting from zero. For renters, that “apartment insurance” (often just $15/month) protects your belongings when your landlord’s policy won’t. It’s cheap therapy: Know you’re covered, and suddenly life’s risks feel… manageable. Plus, many policies bundle perks like roadside assistance, identity theft protection, or even hotel stays if your home’s unlivable. Who wouldn’t want that safety blanket?

3. It’s Smarter (and Cheaper) Than Going Solo Sure, premiums sting, but shop around—discounts for safe driving, bundling policies, or good credit can slash costs by 20-30%. And get this: Claims often pay for themselves. The average car insurance payout? Over $3,000 per incident. For homes? $10,000+.

You’re essentially pre-paying for a massive “get out of jail free” card that could save you way more than you shell out. Skip it? One bad day, and you’re funding your own recovery fund from scratch. No thanks.

Look, I get it—nobody dreams of writing that check. But insurance isn’t a bill; it’s your backstage pass to resilience in a world full of plot twists. It’s the difference between “I’ll figure it out” panic and “I’ve got this” calm. So next time you pay up, tip your hat to future-you: the one who’s toasting with savings intact after dodging a bullet.

Ready to lock in that protection? Hit up a quote today—your wallet (and sanity) will thank you. What’s one “what if” keeping you up at night?

RENTERS INSURANCE

What Is Renters Insurance? A Quick RundownRenters insurance—often the unsung hero of apartment life—is a policy that safeguards your stuff and your sanity when renting. Unlike your landlord’s insurance, which only covers the building’s structure (think walls, roof, and plumbing), renters insurance steps in to protect your personal belongings, your legal backside if someone sues you, and even temporary digs if disaster strikes.

It’s not legally required in most states (though many leases demand it), but for the price of a couple of takeout meals a month, it’s a no-brainer buffer against life’s “oops” moments.The Core Coverages:

What You’re Actually Buying

A standard renters policy bundles three main protections.

Think of it as a three-legged stool for your rental risks:

Personal Property Coverage: This is the big one—your clothes, furniture, electronics, and even that quirky lamp from IKEA. It kicks in for theft, fire, smoke, vandalism, or sudden water damage (like a burst pipe from upstairs).

Coverage limits usually range from $15,000 to $100,000, based on what you’ve got (average apartment contents? $16,000–$36,000). You can choose “actual cash value” (pays depreciated worth, e.g., your old laptop gets valued at $200) or “replacement cost” (full price for a new one, no depreciation hit—worth the slight premium bump).

Liability Protection: Uh-oh—your guest slips on a wet floor you forgot to mop, breaks their arm, and sues for $50,000 in medical bills. This covers those costs, plus legal defense if things escalate. Standard policies start at $100,000, but bump it to $300,000+ if you’ve got assets to shield (like savings or a car).

Additional Living Expenses (ALE): If a covered peril (fire, storm) makes your place unlivable, this pays for hotel stays, meals, and laundry—up to 12 months or 10–20% of your personal property limit (e.g., $3,000–$6,000 for a $30,000 policy).

Pro tip: Policies come in “broad form” (covers specific perils like fire/theft) or “comprehensive” (broader, but pricier—great for storm-prone spots).What It Doesn’t Cover (And Why Add-Ons Matter)No policy’s perfect. Standard renters skips floods, earthquakes, pest infestations, or wear-and-tear (like that slow leak turning into mold).

It also won’t touch your roommate’s gear or the landlord’s stuff. For high-value items (jewelry, bikes), add a “floater” or “rider” to boost limits. And if floods are a worry? Grab separate flood insurance—it’s cheap but essential in wet areas.How Much Does It Cost in 2025?Good news: It’s wallet-friendly.

Nationally, expect $15–$25 per month ($180–$300/year) for solid coverage. As of mid-2025, averages hover around $18/month or $216/year. In places like California, it’s about $21–$23/month. Your bill? It depends on location (urban spots cost more), coverage limits, deductible ($500–$1,000 is common), and perks like bundling with auto insurance for 10–20% off.The Perks: Why Bother

Beyond the Basics?

Affordable Armor: For under $20/month, protect thousands in stuff from theft (happens to 1 in 40 renters yearly) or fire.

Lawsuit Shield: Medical claims can balloon fast—liability saves you from dipping into savings.

Displacement Buffer: No scrambling for crash pads; ALE has your back.

Extras Galore: Many policies toss in roadside help, identity theft coverage, or even pet damage waivers.

Bottom line: It’s peace of mind that pays dividends—one claim could recoup your premiums for years.

How to Shop Smart and Get CoveredInventory Your Life: List everything room-by-room (use apps like Sortly for photos/receipts). Tally replacement costs to avoid underinsuring.

Crunch the Numbers: Aim for $100k+ liability, replacement cost on property, and a deductible you can swing.

Hunt Quotes: Compare 3–5 insurers (Lemonade, State Farm, Geico) online—takes 15 minutes. Factor in discounts for good credit, claims-free history, or multi-policy bundles.

Read the Fine Print: Check exclusions, sub-limits (e.g., $1,500 max for jewelry), and if college kids qualify under parents’ policies (up to 10%).

Revisit Yearly: Life changes (new gadgets? Moving?)—update accordingly.

In 2025, with rising rents and wild weather, skipping this is like renting without a lock. Grab a free quote today—your future self (and that favorite couch) will high-five you.

CONDO INSURANCE

Condo Insurance Basics: A Quick PrimerCondo insurance—formally known as an HO-6 policy—is tailored for condo owners, bridging the gap between your unit’s interior and the condo association’s (HOA) master policy, which handles the building’s exterior, common areas (like pools or lobbies), and shared spaces.

It’s not a full homeowners policy but protects your personal stuff, liability risks, and interior upgrades against perils like fire, theft, or wind damage. Unlike renters insurance, it includes some structural coverage; unlike traditional homeowners, it skips the full building and yard since those are HOA turf.The master policy’s type matters big time—”bare walls” leaves you covering most interiors (walls in, everything else out), “single entity” handles originals but not your fancy renos, and “all-in” covers more, shrinking your needs.

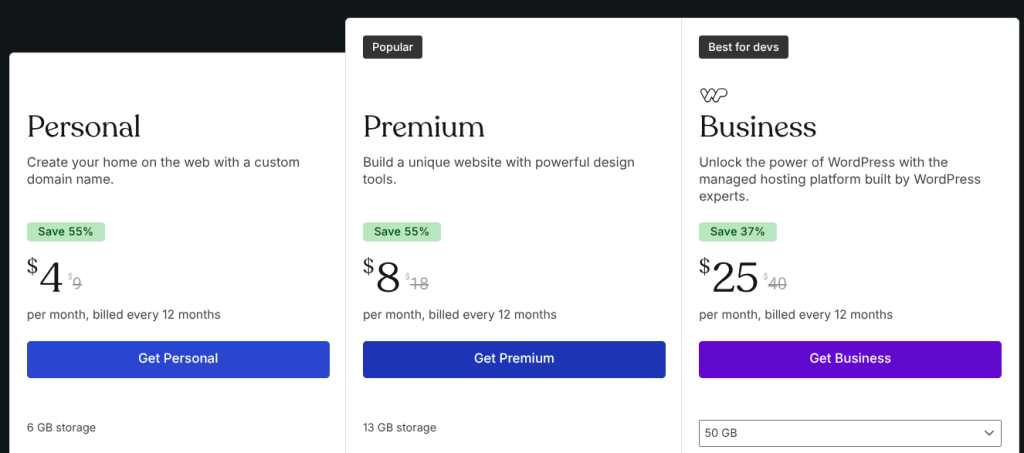

Expect to pay a deductible ($500–$1,000 typical) before coverage kicks in, and add-ons for floods or earthquakes if you’re in a risky spot.Comparing the Big Three: Renters, Condo, and Homeowners InsuranceHere’s a side-by-side breakdown of the basics. These are standard policies (HO-4 for renters, HO-6 for condos, HO-3 for homeowners) as of 2025—costs are national averages and vary by location, coverage limits, and your details (e.g., $50k personal property, $300k liability)

Bottom line: Renters is the budget pick for transient life, condo strikes a middle ground for shared ownership (cheaper than full home but more robust than renters), and homeowners is the heavy hitter for standalone properties.

In 2025, with rising repair costs from wild weather, condo policies are seeing slight hikes (5–10% in high-risk areas), but bundling with auto can save 10–25%.

Leave a comment